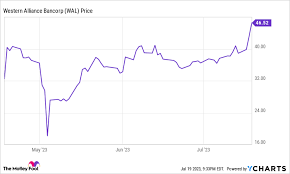

In the midst of the turmoil that rocked the banking industry in the first quarter, Western Alliance (WAL) lost $6 billion in deposits. The Phoenix-based lender’s profits fell 41% from the prior year. Yet the day after disclosing those figures, its stock increased by 24%.

Investors have been watching for any indication that the crisis that resulted in the failure of three US banks in a matter of days at the beginning of March has passed. They are especially interested in hearing from the local institutions that were most affected by the panic that spread throughout the financial system in the short period that followed.

The impact of deposit outflows on the profitability of regional banks

In several business newspapers, numerous executives stated that the deposit outflows they noticed in March have subsequently stabilised or even reversed in reports from more than 15 regional lenders over the past week, which provided a wealth of evidence for this claim. Many of these smaller banks stated that they currently anticipate earning lower interest rates on their loans and paying higher deposit rates, which will impact their estimates for future income and profitability. Others stated that they anticipate increasingly stringent federal banking laws, which would necessitate raising additional funds.

News about company: Their issues begin with deposits, a vital source of funding for smaller institutions. Customers of banks who were receiving little interest on their accounts had already started transferring their cash to higher-yielding alternatives like certificates of deposit or money market funds before Silicon Valley Bank failed.

In March, that outflow picked up speed. Dallas-based Comerica (CMA), a regional bank, reported a 9% decline in deposits for the first three months of the year. Lender Zions (ZION), based in Salt Lake City, reported a 3.4% decline.

Due to the need to retain or entice depositors, several local lenders were pushed to start offering higher rates. Deposit expenses for Comerica increased by 2,850% to $118 million from a year ago. These expenditures at Zions increased by 1,266% to $82 million. The hikes were 4,245% and 2,400%, respectively, at lenders Fifth Third in Cincinnati (FITB) and KeyCorp in Cleveland (KEY). One of the banks that Moody’s downgraded on Friday was Comerica, and another was Zions.

Ethan Wilson