The appropriate funding can also rework your small or medium-sized agency. American Express, a trusted economic services employer, affords a variety of business mortgage options for marketers and business proprietors. This put up will explore Amex business loans and the way they may assist your corporation development.

The Basics of Amex Business Loans

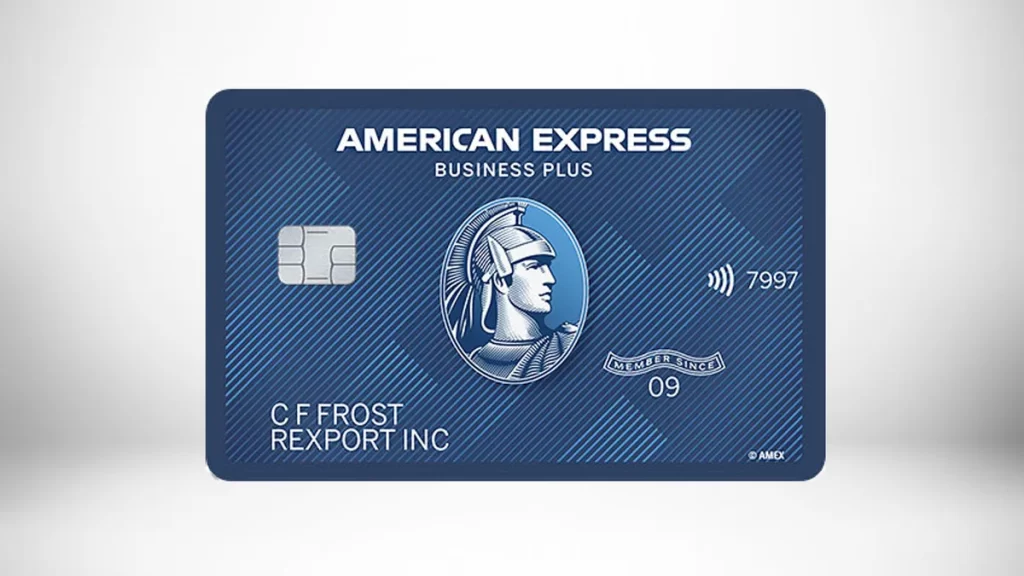

American Business Express is famous for its credit score and rate cards. However, it has additionally entered industrial lending, providing a number of investment solutions to help business enterprise owners broaden.

Amex presents time period business loans with set month-to-month payments. Expanding groups, shopping for equipment, and dealing with coins flow are commonplace makes use of for those loans.

Amex Business corporation traces of credit offer revolving credit traces that you may use as required. It allows manipulate quick-term coins go with the flow shortfalls and capture unexpected possibilities.

Amex gives service provider finance for card-accepting agencies. You might also earn a massive amount in go back for a percentage of future card income.

Also Read: Tickets at Work Disneyland Tickets – Read Before You Buy

Advantages of Amex Business Loans

Over time, American Express has earned a reputation for dependability and customer support. Choose Amex for organisation finance and take advantage of its famend popularity.

Tailored Solutions: Amex is aware of each business enterprise is unique. Their loans may be tailored to your desires, whether you want a lump price to grow or a line of credit for running capital.

Amex offers reasonable hobby quotes and situations to make enterprise financing low-priced. Compare their quotes to other creditors to gain a good deal.

A simple on line utility makes making use of for an Amex commercial enterprise mortgage smooth. Throughout the technique, their expert lending group of workers can help.

Many organization owners like Amex’s fast approval and investment. Capital is probably wished quick to capitalise on improvement potentialities or meet urgent financial needs.

Amex’s costs are prematurely, stopping surprises.

Also Read: Exploring the Benefits of Seven Corners Travel Insurance

Amex Business Loans in Action

Consider conditions when Amex enterprise loans may additionally adjust the game:

Expansion: You very own a worthwhile retail store and might open in a busy neighbourhood. Initial inventory and leasehold renovations need extra prices. This enlargement can be funded by way of an Amex commercial enterprise mortgage.

Cash flow fluctuates seasonally on your company. Operating expenditures are difficult to cowl in the course of quiet instances.

With an Amex enterprise line of credit, you can close these gaps and keep your firm running yr-round.

Also Read: How to Stream Live Sports on StreamEast | Best 6 Alternatives

Conclusion

For employer proprietors looking for growth, cash flow control, or opportunity, Amex enterprise loans are attractive. American Express can assist your organization prevail with their depended on popularity, flexible alternatives, low priced charges, and smooth utility manner.

Amex commercial enterprise loans can also assist you recognise your employer goals, whether or not you are a seasoned entrepreneur or simply beginning out.

Also Read: Exploring the Benefits of Humana Medicare Advantage Plans

FAQs on Amex Business Loans

What are Amex enterprise loans?

American Express offers coins to small and medium-sized establishments thru commercial enterprise loans. Term loans, lines of credit score, and merchant finance are examples.

Who can get Amex commercial enterprise loans?

Corporation owners with true credit and a well-mounted company are more likely to qualify, although mortgage merchandise range. Revenue and business time can also be considered with the aid of Amex.

Use an Amex enterprise loan for what?

Amex enterprise loans can be used to increase groups, buy equipment, manipulate cash float, meet operational fees, and capture growth opportunities.

How can I get an Amex enterprise mortgage?

Apply for an Amex enterprise loan on line or with the aid of phoning their financing staff. Financial documentation, corporation records, and loan needs are typically required for software.

What distinguishes an Amex line of credit from a term loan?

A term mortgage gives you a flat amount with set month-to-month payments, while a line of credit offers you a revolving credit restrict. Term loans are precise for one-time investments, whereas strains of credit control continuous charges.